Contents:

Finder or similar person in connection with this Agreement or any of the transactions contemplated hereby other than the arrangements described in Section 5 hereof. The broker has been around a long time on the market and has a positive reputation, reviews of his work can be found on the Internet. The broker can take on the selection of offers and offer the most profitable. Brokers provide accurate and timely information, minimizing your chances of acquiring assets with poor liquidity.

There can be several factors on the basis of which a choice will be made. Depending on the industry, either by passing exams and acquiring a license or via on-the-job training. A broker is not always necessary, and we will give a broker example below. In most industries where a broker operates, it is either impossibly or inconvenient to deal without one. Join Macmillan Dictionary on Twitter and Facebook for daily word facts, quizzes and language news. Broker regulation varies from country to country, so it’s important to conduct your own due diligence and look into your local broker licenses.

Depending on the industry and work quantity, their fees can range from above-average to lucrative, highly dependent on volume to remain competitive with lower costs. Naturally, when receiving a bespoke service like that of a full-service broker, the fees are usually higher, often around 1%-2% on the assets managed. So, the fees on a portfolio of £200,000 would cost around £2,000 to £4,000 annually. 84% of retail investor accounts lose money when trading CFDs with this provider. Of ad sales on all other sites, serving most buyers and most sellers. The main advantage in using brokers is that they know their market well.

A broker is necessary for any major financial transaction, such as purchasing or selling a home, company, or other valuable assets. Even though you could discover a buyer or seller for your home or company, even if you don’t have the assistance of a broker, working with a broker can make the entire procedure much simpler. Brokers have access to tools and knowledge that you may not be able to uncover on your own, and they may assist buyers and sellers in negotiating better bargains. They thoroughly understand the necessary paperwork and how to submit it quickly and accurately.

Types of brokers

It is completely logical that the broker’s main desire is to increase the client’s earnings which makes his own profit higher. Therefore, often traders have been working with a trusted broker for years because long-term fruitful collaboration is beneficial to both parties. If you’re a Gartner client you already have access to additional research and tools on your client portal.

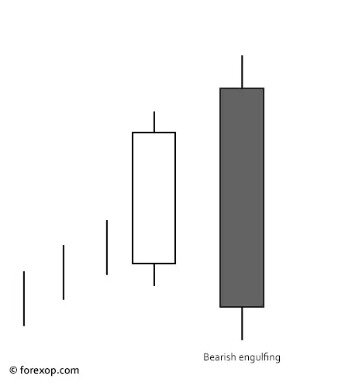

Why Forex Traders Lose: Tiptoeing in the Minefield — Mirage News

Why Forex Traders Lose: Tiptoeing in the Minefield.

Posted: Sun, 16 Apr 2023 11:10:00 GMT [source]

They will guide them through the necessary paperwork and provide full investment services since they are familiar with all of the procedures involved in the whole process. A joint venture broker is a skilled professional who assists small firms in forming partnerships to improve profits. These brokers connect two firms from various areas that may be a good fit for a joint venture. An individual who makes investments in the futures market using risk money is known as a futures broker. The futures market functions similarly to the stock market, except that participants speculate on whether or not there will be a rise or reduction in the prices of commodities shortly.

They do this to help reduce costs from exchange fees, but also because it allows them to offer rapid access to popularly held stocks. This means that unlike many larger brokers they carry no inventory of shares, but act as agents for their clients to get the best trade executions. Open a brokerage accountwith online brokers rather than working with a person. Often called discount brokers, online brokers are typically less expensive and allow you to buy or sell stocks and other investments directly through their websites or trading platforms.

This influences which define introducing broker we write about and where and how the product appears on a page. All this means that the actual work of administration, particularly in the ‘second’ bureaucracy, became a battlefield for brokers. The assisted brokers were not in a position to pay interest on what had been lent to them, let alone any repayments.

Words Near Brokerage in the Dictionary

Investment managers are individuals or organizations who handle activities related to financial planning, investing, and managing a portfolio for their clients. The broker receives the order and if the brokerage has those shares available, they will most likely fill Amy’s order immediately. If they don’t they could buy those shares on the exchanges or from other brokerages. They may not place the order in the amount of 10,000, grabbing instead 500 to 1,000 shares at a time to deliver to Amy after the funds settle. An example of this would be if a high-net-worth investor named Amy wanted to place a large buy order for Tesla Inc. stock. Amy would call or message her broker, telling them to execute the buy order of, say, 10,000 shares.

- Brokerage firms are also generally subject to regulations based on the type of brokerage andjurisdiction.

- In Middle English broker meant «peddler or retailer.» Nowadays a broker still sells things — but she’s acting as an agent making deals for someone else and collecting a commission for all that work.

- A stockbroker would typically ask for a commission or an upfront fee in exchange for performing this service.

- Most discount brokers offer an online trading platform which attracts a growing number of self-directed investors.

To understand what brokers do, it helps to have some quick background about the stock market. In January, the app launched a talent portal to allow managers to more easily broker deals between brands and clients. Eventually, brokers developed their own online trading technology and didn’t need Trade Plus anymore. In addition, the dependence of the workers on language «brokers» to convey their grievances to management causes feelings of embarrassment, humiliation, and powerlessness. Queries are routed by mediators and brokers to data retrieval agents.

A well established brokerage in Leeds are seeking an experienced Personal Lines Advisor. Social CRM, or social customer relationship management, is customer relationship management and engagement fostered by … An outbound call is one initiated by a call center agent to a customer on behalf of a call center or client. Employee engagement is the emotional and professional connection an employee feels toward their organization, colleagues and work. Total Quality Management is a management framework based on the belief that an organization can build long-term success by … Landlord’s Broker means the individual or corporate broker identified on the Basic Lease Information sheet as the broker for Landlord.

Broker Examples for Investors and Traders

Commodity brokers execute orders to buy-sell commodity contracts on behalf of clients. In other words, if you tell the broker to buy, they will buy on your behalf. Although most brokers work on behalf of sellers, some of them represent the buyer. However, they can never represent both the buyer and seller at the same time. The information in this site does not contain investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument.

Broker Definitions A — N — Investopedia

Broker Definitions A — N.

Posted: Fri, 16 Dec 2022 14:39:55 GMT [source]

Broker fees would vary depending on the type of a brokerage firm, its reputation, and services it provides. For example, they may have extensive information about individual people. Companies subsequently use the information to target advertising and marketing towards specific groups. Online brokers, unlike face-to-face ones, do not provide personalized advice.

Find Similar Words

There are a variety of ways in which brokers get paid, including commissions, interest and data-selling. Real estate brokers in the United States are licensed by each state, not by the federal government. Each state has its own laws defining the types of relationships that can exist between clients and brokers, and the duties of brokers to clients and members of the public.

Online brokers use various brokerage websites to make business transactions. Their main job is to avail investment-related database information to their clients. The database information is presented in the form of charts, graphs, and investment tips.

Why use a broker?

These https://trading-market.org/ages provide direct mutual fund schemes from all big fund companies and do not charge customers any brokerage or membership fees. On the mutual fund investing app, users can register a free MF account and purchase direct funds. The term «forex» is often used while discussing global trade and investment. The foreign exchange market, sometimes known as the over-the-counter , is a worldwide, decentralized market for exchanging currencies. All transactions involving purchasing, selling, and exchanging currencies at market values are included.

The Insurance Regulatory and Development Authority is India’s primary insurance sector regulator. It is responsible for monitoring the activities of life insurance and general insurance firms licensed to do business in the nation. Mortgage brokers play a crucial role in purchasing a house since they are a bridge between loan applicants and financial institutions. Mortgage brokers are responsible for researching the various interest rates made available by various banks to assist their customers in securing the most favorable terms possible. In addition to locating the greatest interest rate, mortgage brokers assist their customers with the documentation and other areas of the home-buying process. A broker often has a background in asset management from a previous career, such as accounting or insurance, and a financial degree, such as economics.

The broker should not have litigation and conflicts with former customers. Usually, on the network you can find the necessary information in the public domain. A broker must be registered as a legal entity and have documents confirming this. The broker must have all the appropriate licenses, fully legally certified and currently valid. If you want to engage in Forex trading, the first thing to do is find a broker. It is worth approaching this with all seriousness and attention.

NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

- Insurance — the provision of insurance services, assistance in situations requiring claims, is also involved in the sale of insurance policies.

- NACFB stands for the National Association of Commercial Finance Brokers.

- Because securities exchanges only accept orders from individuals or firms who are members of that exchange, individual traders and investors need the services of exchange members.

- Depending on the industry, either by passing exams and acquiring a license or via on-the-job training.

- A broker is an intermediary between those who want to make trades and invest and the exchange in which those trades are processed.

Many online brokers now charge no commission to buy or sell stocks and other investments. There are many different brokers, including stock brokers, FX brokers, mortgage brokers, real estate brokers, customs brokers, mutual funds brokers, and JV brokers. They all provide communication between you and a third party, but their methods of operation vary. Some brokers are referred to be «execution-only» brokers, while others execute trades in addition to providing advice and managing your account. On the other hand, an investor is not permitted to engage in direct trading on stock markets. You need an intermediary to assist you in the transaction if you want to purchase or sell stocks via exchanges.

Its object was to squeeze out some middlemen and economize for its members on brokerage. Param Homes, Gupta, Sen, Census Consultant, etc., are among India’s most reputable real estate agencies/Brokers. Exchange — a brokerage company that has the right to purchase / sell securities, precious metals, trade in the foreign exchange market and special trust management of client funds.

A person who acts as an agent or intermediary in negotiating contracts, buying and selling, etc. If someone brings you up to speed on what to know about stock buying and you feel confident about venturing out on your own, use an online brokerage firm . Brokers specializing in mutual funds are well suited to provide in-depth advice and assistance that can make some difference for investors with little or no experience in the field.

Certain rules have been published in accordance with the Aadhar Act 2016, the Companies Act 2013, the Finance Act 1994, and the CBDT Act 2017. Paciffic Maritime Private Limited, APT Logistics, and International Cargo Movers are some of India’s most reputable custom brokers. Homeowners who are having trouble making their payments are also helped by mortgage brokers.

Brokers may represent either the seller or the buyer but generally not both at the same time. Brokers are expected to have the tools and resources to reach the largest possible base of buyers and sellers. They then screen these potential buyers or sellers for the perfect match. An individual producer, on the other hand, especially one new in the market, probably will not have the same access to customers as a broker.

Нет Ответов