Contents:

The Gann angles are visually spread out like a fan; hence the name Gann Fans. Gann fans offer an easy way for traders to plot these angles. The fans consist of nine diagonal lines that use the price-time relationships described earlier, as seen in the diagram. This offers a broad perspective on where the price may end up and helps to forecast potential support and resistance levels.

As market is still unstable we would like to share with you interesting and promising strategy which can help you to get calmer. It presents in a elegant way current trend and tells us when to buy and sell or when we have to just wait for the final verdict. This indicator is notable unique because it draws diagonal support and resistance levels at… One of the main reasons why Gann fan angles are superior to the horizontal support and resistance levels is that financial markets are geometric in their movements. Our team at Trading Strategy Guides has developed the best Gann fan trading strategy. It can be applied to all markets because according to the Gann theory, financial markets move as a result of human behavior.

Traders lost all sleep wondering how he achieved such stellar results. Investors and traders use Gann Fan to identify support, resistance, and trendlines within the Forex markets. There are charting platforms providing Gann Fan indicators, but still, some flaws may occur. Sometimes you won’t be able to find an angle tool for setting a 45-degree line at a true 45 degree angle.

- During the 20s and 30s, wheat and cotton prices didn’t change much.

- There seems to be a lot of misunderstanding about applying this tool.

- Further intersections of the Gann line signals that the balance has been disrupted.

- Those above the 1/1 line (2/1, 3/1, 4/1, 8/1) progressively more bullish.

- These Gann angles are primarily used to predict future support and resistance levels, plotted by the Gann fan indicator.

- Before you can start trading, pass a profile verification.

Use the 1/1 diagonal line to gauge if price downtrend is slowing – Establish if price has found support and is it trading above the 1/1 line. A bearish sentiment is typically considered when price stays below the 45 degree line in a downtrend. When price stays above the 45 degree line on an uptrend the sentiment is considered bullish. Fan lines are primarily used as support and resistances levels and areas. W.D. Gann’s indicators and theories are mathematically based.

What Is The Gann Fan Indicator & How To Trade With It

If https://traderoom.info/ moves below this line in an upward trend the upward trend momentum may be reducing. As we can see from the image below, graphically, the Fan of Gann consists of a series of lines that open “fan” starting from a point . In a little while, we will see that these lines from a technical point of view will become our support and resistance levels. They are also distributed according to a precise angle (the angles or “Fan of Gann”), and this too takes on great importance, as we are about to see. That’s why it pays to apply some basic technical analysis principles, such as support and resistance levels, and identify specific patterns when using this indicator.

If price is situated below the blue line of the Exponential Moving Average , it denotes a bearish trend. If the silver histogram of the OsMA custom indicator crashes into the 0.00 level, it is an alarm that price pressures are to the downside. While there are some drawbacks to using the Gann Fan Indicator, these can be mitigated with proper understanding and implementation of the indicator. You can easily find accurate entry and exit points on your trades. Fan lines provide reliable indications of when it might be a good idea to buy or sell Forex pairs.

The Gann fan tool is made up with nine diagonal lines created to present different areas of support and resistance on a chart. These angles are drawn from main tops and main bottoms and these angels are used to perform the function of dividing the time and price proportionately. Traders and technical analysts use the result of these angles after placing on a chart to forecast support and resistance areas, price movements in future, and principal tops and bottoms. In order to ensure the square market relationship, the proper scaling of the chart plays a very important role. D. Gann developed the Gann Fans based on the price and time movements with the aim of forecasting price changes through analyzing support and resistance areas. The theory of Gann’s is depended on the price and time movements with one time unit by the one price unit being the 45-degrees angle.

For example, you can predict using Gann angles that after 3 days, a strong support level will come in the EURUSD currency pair. As with each of the Gann charts shown in this article, these angles aren’t guaranteed to hold. This might help traders identify opportunities where prices will likely continue trending. The choppy area marked by the box in the diagram above could have shown us that the price wasn’t ready to reverse up, given that it closed below the 3×1 line several times.

Gann Fans, use proportions of time and price to calculate an angle. In this post I’ll explain in detail what are Gann fans, How they’re calculated, How to use them in your trading. I’ll provide a simple Gann fan trading strategy also show you how to use the Gann fan indicator using Tradingview. The best Gann fan strategy has a very clear level where we should place our protective stop-loss order which is right below the swing low located prior to the 1/2 Gann angle breakout. This step is significantly important because a reversal of the previous trend is only confirmed once the 2/1 Gann angle is broken to the upside. You want to buy at the market as soon as we break above 1/1 line.

The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organisation, committee or other group or individual or company. Finished analysis of 2014 Nov Beans using price scaled Gann fans. We have special Gann fan angles and more specifically Gann came up with 9 different angles .

The indicator uses price levels to determine the levels of support and resistance in the future and, therefore, the same levels will show up across every price chart. Thus, traders can utilize the indicator and watch price movements in the lower time frame close to the resistance and support levels to find the best entry locations. These are the most common questions about the Fan Gun indicator. This trading system is a complex strategy that uses diagonal support and resistance levels.

Copy and paste the Gann Fan.mq4 into the MQL4 Experts folder of the Metatrader 4 trading platform. After his death, Gann became a legend in the financial community. His talent to make mind-blowing profits on everything from trading to racing to the Cuban lottery, earned him an almost mystical reputation. His ability to make accurate predictions fascinated people. They said that he once made a bet in the Cuban lottery.

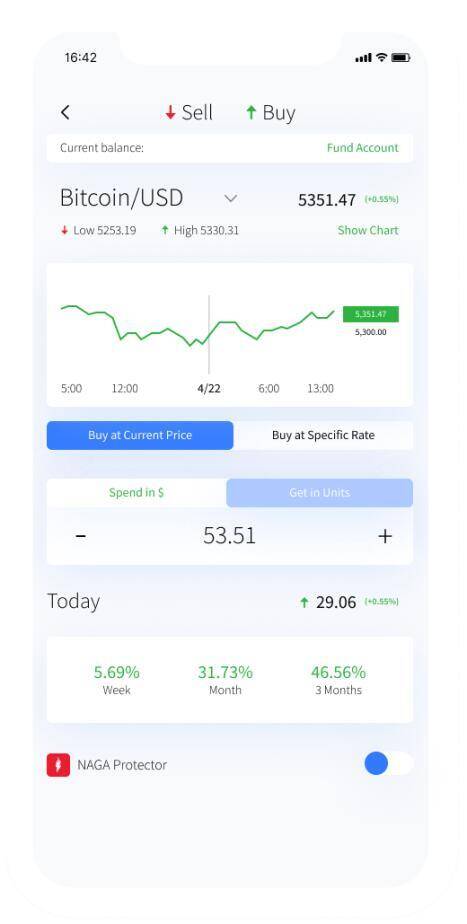

Live prices

These are the trading rules of the best Gann fan trading strategy. This statement may sound obscure, but we’ll go through some examples shortly. You’ll get a better understanding of how to use the Gann fan indicator, and more importantly how to draw Gann fan angles.

I have spent many years testing and reviewing forex brokers. IC Markets are my top choice as I find they have tight spreads, low commission fees, quick execution speeds and excellent customer support. Gann Fan Indicator is made up of simple trendlines and helps determine the potential for a reversal in the trend. In the world of trading, the name of William Delbert Gann is one of the best known. This mathematician, dubbed as a trader famous for his study of cycles, has developed a technical indicator. Improper scaling will result in inaccurate angles and misplaced support/resistance lines.

Gauging a Trend’s Strength

In case you funded the gann fan indicator via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums. You need to again use the Fan Gun indicator to a minimum of oscillation before breaking above 2/1 of the Gun fan angle. At this point, you can remove previous Gann corners so you don’t clutter the chart.

Fès/Tourisme: Jnane Sbil sur les traces du Jardin de Majorelle … — L’initiative

Fès/Tourisme: Jnane Sbil sur les traces du Jardin de Majorelle ….

Posted: Fri, 17 May 2019 07:00:00 GMT [source]

Furthermore, he predicted a positive tendency in the market in 1921 and the end of the bullish trend on September 3, 1929. During the 20s and 30s, wheat and cotton prices didn’t change much. In 1935, Gann profited from 83 out of his 98 trades on cotton, grain, and rubber.

Gann Fan sell signal

FXOpen is a global forex and CFD broker, with a network of worldwide brokerages regulated by the FCA, CySEC and ASIC. FXOpen offers ECN, STP, Micro and Crypto trading accounts . We also want to add a buffer of 20 pips to the 1/1 Gann angle breakout just to annihilate possible false breakouts. A trendline, on the other hand, does have some predictive value. However, because of the constant adjustments that usually take place, it’s unreliable for making long-term forecasts. Your website access and usage is governed by the applicable Terms of Use & Privacy Policy.

The primary 45-degree Gann angle is the 1×1 line, where the market moves one unit of price for every unit of time. The Gann fans refer to a gauge of technical analysis created by W. D. Gann based on the premise that the prices in market move in predictable patterns and nature of market is geometric and cyclical. A Gann fan is made up with a series of lines, which is known as Gann angles.

A helicopter or a plane? China’s new futuristic military aircraft is both — George Hatcher’s Air Flight Disaster

A helicopter or a plane? China’s new futuristic military aircraft is both.

Posted: Thu, 09 Mar 2023 08:00:00 GMT [source]

Gann square 9 indicator MT4 draws supports and resistance lines along with the price charts. Additionally, the indicator employs the traditional Zigzag Meta Trader indicator to identify the changes in trend. The Gann Grid is an array of trend lines plotted at the angle of 45°. As you might’ve already guessed, these trend lines are the Gann lines which we’ve covered above.

Gann Fan indicator is also very reliable; while trends can often be hard to predict, this indicator provides accurate predictions based on how it’s configured. However, it must be used cautiously, as trend lines don’t always line up perfectly due to market volatility shifts. The unique angles provide more accurate and reliable information about longer-term trends. Very often, the daily price will be too far from the breakout price, and the sum to be lost in case of failure will be too great; you will then renounce the project of your own accord. Don’t go against the market trend and trade in liquid markets.

Additionally, the groups assist traders in identifying the Stop-loss and take-profit levels. With our guide, you can quickly learn how to use the Gann Fan and put this knowledge into practice. Gann’s strategy will allow you to accurately determine the entry point and take the maximum profit from the price movement. Traders use the Gann Fan to identify potential key levels of support and resistance and to determine entry and exit points for trades.

In the toolbar you need to choose “Insert – Fibonacci fan”, remove all previous values and will put in the obtained values. But this problem is solved by another, relative, instrument, which is built on the basis of percentage. To convert the angles according to settings of the Fibonacci fan, you need to deduct the tangent of required angle from tangent of 45º angle . Lastly, the OsMA.ex4 is built out of the EMA , EMA and SMA , making it a good trend following tool. The Exponential Moving Average is built to provide weight to the most recent data.

He is well-known for using geometry, astrology and ancient mathematic to predict the movement of quotes in the financial markets. Gann’s strategy allows you to move on a new trend for as long as possible, and with the help of the Fan Gann indicator, we can determine the ideal time for profit. We take profit at the earliest sign of market weakness, which is a break below the 1/1 line, which signals a possible beginning of a bearish trend. To eliminate the possibility of a false breakthrough, we add 20 points to the breakthrough of the Gann angle 1/1. The 45 degree line represents 1 unit of price movement with 1 unit of time.

Most sophisticated trading platforms should incorporate these tools. On the Tradingview platform, you can locate the Trend Angle tool on the left-hand side panel . W.D. Gann, the creator of Gann fans, found the 45-degree angle to be the ideal angle for charting based on his theories regarding the balance of time and price. Cory Mitchell, CMT is the founder of TradeThatSwing.com. He has been a professional day and swing trader since 2005. Cory is an expert on stock, forex and futures price action trading strategies.

Нет Ответов