Contents

You may please also note that all disputes with respect to the distribution activity would not have access to Exchange investor redressal or Arbitration mechanism. In case any trader has its own trading strategy and wants to try its fate with his own strategy, then they can create an algo out of their own unique strategy with the help of a professional coder. Think about your favorite e-library, checking your e-commerce account’s mobile app or checking traffic before you decide to step out of your house.

However, the ongoing investment in technology in computers and other fields suggests that algo trading is widely accepted in the western world. Essentially, it is a step in the evolution of trade resulting from technological advancement. So algo traders define the asset’s price range and ensure that the asset transaction occurs if it pops in or out of the specified range. Investors often look to execute orders nearer to the volume-weighted average price.

With algorithmic trading, you must be able to design and test quantitative trading strategies for stocks, commodities, FX, futures, cryptocurrencies, and bonds. Due to its widespread use, SEBI declared in 2022 that “an Algo trading software in India” requires a new regulatory structure. Hence, given the prevalence of algorithmic trading, a thorough understanding of “an Algo trading software in India” is necessary. Human traders are generally influenced by emotional and psychological factors which are not the case with algorithmic trading. A computer program is designed in a manner that monitors the prices and places the orders when conditions are met. Algorithmic trading requires expertise in statistics, technology, and financial markets.

However, algorithmic trading is highly technical and requires immense knowledge related to the financial market, data analysis, and computer programs. Furthermore, algorithmic trading demands access to past asset performance, live market feed, and a detailed infrastructure of trading platforms and integrated networks. This is one of the most simple algo trading strategies, which is popular among traders/investors in India. Algo traders usually follow trends like moving averages, channel breakouts, and price movements to curate codes for the algorithmic trading software. They leverage these indicators that make for the simplest executable strategies that do not deal with any kind of predictive forecasting. Algo trading is the best avenue for traders looking to minimize errors related to human intervention and build profits.

Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor’s account. This tip is a value for money for all i.e whether one can see the trading terminal or not or is dealing through a broker on phone at BSE, NSE or in F&O. Thus you are on a correct path of making money every day with single daily accurate tip. To conclude we can say that Algorithmic trading needs to be undertaken under supervision only and do check our best intraday tips or Bank Nifty option tips which produce profit every day.

Is Algo Trading Profitable in India?

This kind of trading is also called automated training and black-box trading. The uniqueness of algorithmic trading comes from the strategy of trading it uses. With the aid of a programmed set of computerised algorithms, trades are executed on the stock market. Algorithms are defined sets of instructions, and through this kind of trading, profits can be produced at frequencies and speeds unheard of in human traders. Algorithmic trading is a method of executing trades using automated, pre-programmed trading instructions, rather than making decisions based on human intuition or experience.

- However, it is this volatility that has been a major factor behind its universal spread.

- Each exchange may use a different format to provide its data feed.

- Thus you are on a correct path of making money every day with single daily accurate tip.

- The Ultimate plan offers extra back tests per day, live strategies, unlimited scans, etc.

But next day, the stock that you bought which you were expecting to go up, gaps down. You start to think, if I hold onto it for few more days, the stock could recover back to entry price, so that you could exit without any loss, so you start praying that the stock could just recover. The trends used is algo trading profitable in india are moving averages, breakout, price level movement, etc. This is the most straightforward strategy to implement, as the strategy does not require any prediction of price. It is machine enabled training where you start by writing one line of a code in python by watching a 2-5 minute video on it.

Even, experienced and professional traders and wealth managers use it for enhancing their trades more efficiently and effectively. Programming Skills Although some algo trading software allows you to trade with absolutely zero coding but the programming knowledge will give you a competitive edge. You can start learning programming languages such as Java, C++, etc., and practice them regularly. AlgoTraders is one of the best open source algo trading platforms in India with immense popularity. Its latest version uses an Esper engine that helps it to operate at a very high speed.

Top Features Of Algo Trading Software In India

These advantages are available at a price that is within reach for most people. As a result, it is India’s most sought-after automated trading program. Customers of Zerodha may use Zerodha Streak free for seven days.

Algo trades demand data analysis, coded instructions, and an understanding of the financial market. Investors must learn algo trading before doing algorithmic trading with real money. Algorithmic trading also allows for faster and easier execution of orders, making it attractive for exchanges. In turn, this means that traders and investors can quickly book profits off small changes in price. The scalping trading strategy commonly employs algorithms because it involves rapid buying and selling of securities at small price increments.

Get Daily Prediction & Stocks Tips On Your Mobile

Thirdly, algo trading works really in repetitive orders as it can execute conditional orders at a speed that humans cannot beat. Again in 2010, NSE permitted large institutional brokers to co-locate their trading server in the exchange premises with a dedicated connection link from the exchange. This co-location gives a millisecond advantage over normal investors. You can algo trade on platforms such as MetaTrader 5, AlgoNomics, Omnesys Nest, TradeTron, etc. They allow you to easily create an account and start with algo trading. Additionally, it also offers services such as copy trading, freelance data for strategy developers, virtual hosting, trading robots, and more.

SEBI, the Security Exchange Board of India, has issued certain guidelines to make trading fair and profitable for investors. MetaTrader 5 is a multi-functional algo trading platform that was formerly known as MetaTrader 4. This automated trading software allows traders to deal in commodities and stock, whereas the earlier one was a forex market-centric platform. Algo means algorithm, and algo trading refers to a process in which stock trading is done using algorithm-based software.

Further, traders can set a maximum risk percentage which will tell the algo trading software when to stop trading. In addition to this, this software also enables traders to customize their strategies by combining certain parameters, with zero https://1investing.in/ coding. Traders can set their own algorithms that can buy and sell orders when the desired conditions are met. With automated trading software, traders don’t need to continuously monitor live prices or graphs to place their orders manually.

Thus, NSE wants to advance by applying AI, particularly machine learning (from social networking sites, news websites, and much more.). If you liked this article, please do share share it with other Traders/Investors. We generally look for strategies which have a minimum win to loss ratio of 55 to 60. The difference in this form of trading and normal trading is using the power of statistics to increase the probability of success.

Algorithmic Trading Evolution in India

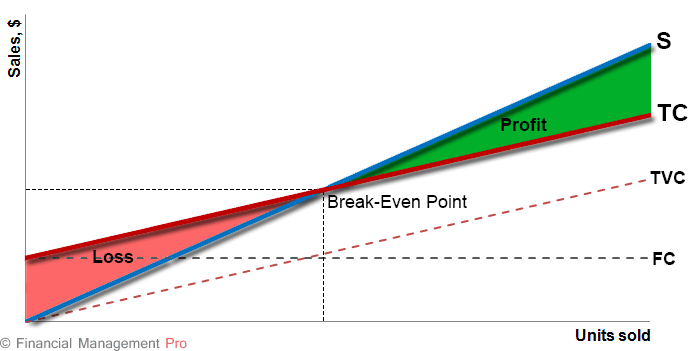

So even a rupee gain in stock price, could result in huge gains for you. But they forget that, a one rupee decline in stock price could wipe out your capital. The strategy breaks a large order and releases a smaller chunk of order using evenly divided time slots between a start and an end time.

Algorithmic traders trust one of the best algo trading software in India with their capital and rely on it to make wise selections. As a consequence of technological advancements, our actions rely on technology and, more recently, artificial intelligence. The same is accurate for the stock market, where investors are now assisted with trading decisions by the best algo trading software in India. A lot of individual traders are using LFTs by automating their trading strategy.

Нет Ответов